November 22, 2025 Crypto Pulse: BTC Eyes $85K, ETH Under Pressure & SOL’s Divergence Plays

Market Update – November 22, 2025

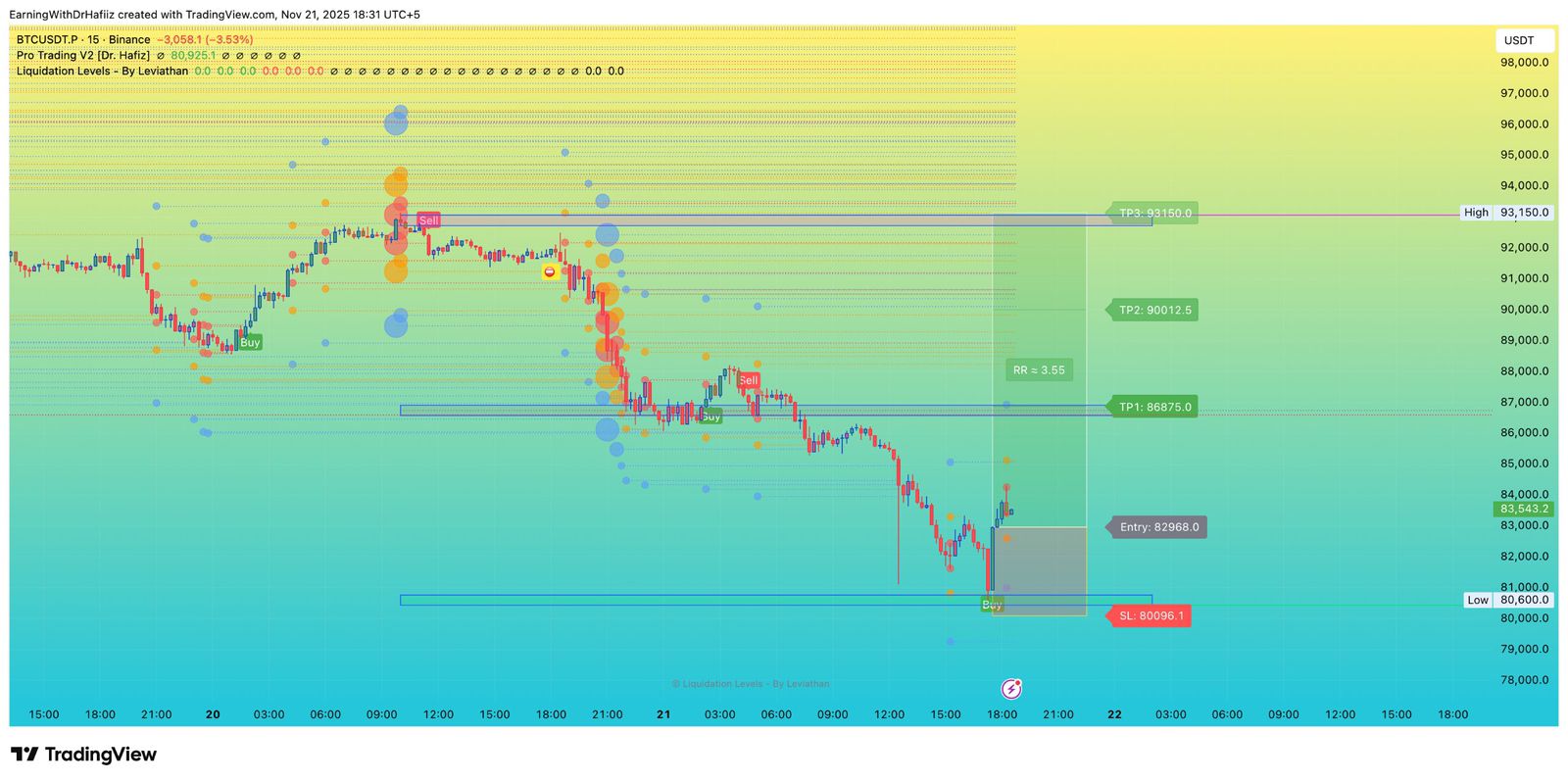

Bitcoin (BTC) Technical Outlook

As of 22 November 2025, Bitcoin is trading around $84,000. TechStock²+1 After a volatile November, BTC is attempting to stabilize and reclaim key territory. TechStock²+1

Support Levels:

- Near $82,000 is a critical zone, with the broader $80K region acting as a strong cushion. TechStock²+1

- If that fails, further downside could test $78,000–$80,000, but for now, the $82K area is where sellers may run out of steam. Alpha Node Capital

Resistance Levels:

- On the upside, $85,000–$86,000 is the immediate resistance band. TechStock²

- A sustained break above $90,000 could open the door to a more bullish leg — but for now, this mid-$80K zone is the key battleground. TechStock²

Volume & Flows:

- According to reports, Bitcoin spot ETF inflows have turned positive again after sustained outflows, indicating renewed institutional interest. 99Bitcoins

- However, overall volume remains under pressure, and ETF flows are being watched closely as a potential driver for direction. Alpha Node Capital+1

Market Structure:

- The technical setup is cautious: a channel-down pattern is forming, with lower highs and lower lows, suggesting weakening confidence. Alpha Node Capital

- That said, on-chain data points to accumulation by long-term holders (“whales”), which could limit how deep this correction goes. Alpha Node Capital

- If Bitcoin locks in support around $82K–$80K and ETF inflows persist, we could see a countertrend rally back toward the mid-$80Ks. But if support breaks, the risk of a deeper correction rises.

Ethereum (ETH) Technical Outlook

Current Price Pressure:

- Ethereum is under strain, with ETH trading near $2,845, reflecting a roughly 10% weekly drop. Brave New Coin+1

- A large portion of this decline has been exacerbated by $950M+ in leveraged liquidations, which has added to short-term volatility. Brave New Coin

Support Zones:

- A key technical support to watch sits around $2,500, according to some wave-theory correction models. Brave New Coin

- On a more moderate basis, analysts point to $3,500–$3,600 as a critical zone: breaking below could trigger further downside toward $3,174 (Fibonacci level) or even $3,000 in a more aggressive drop. WEEX

Resistance Zones:

- On the upside, ETH faces resistance around $3,800–$3,900, which has acted as a previous turning point. WEEX

- For a meaningful recovery, ETH would need to clear this zone decisively, potentially targeting $4,000+ in the medium term, but that requires strong buying momentum.

Outlook:

- The short-term picture is bearish, with strong downside risk if support failing near $2,500.

- But if macro sentiment improves or ETF flows into Ethereum reverse, ETH could stabilize and attempt a retest of $3,800+ — though that’s not guaranteed given current pressures.

Solana (SOL) Technical Outlook & Divergence

Price Context:

- Solana is trading around $128–$130 on 22 November 2025, based on recent historical data. Yahoo Finance+1

- Despite a 49% drop from its September high, there is a bullish divergence emerging. TradingView+1

Support Levels:

- According to technical models, $120–$125 is a strong base zone, which could absorb further selling. AInvest

- According to volume-based support levels, SOL may also find some relevance near $127–$126. StockInvest

Resistance Levels:

- Key resistance clusters lie in the $175–$185 region, if SOL were to mount a strong rebound. AInvest

- On the nearer term, resistance is likely around $133 (standard-deviation resistance from recent price data). Barchart.com

On-chain & Ecosystem Signals:

- Santiment reports that active on-chain addresses and new SOL wallet creation are rising, signaling bullish divergence even as price drops. TradingView

- Developer activity remains strong: despite price declines, Solana’s ecosystem continues to attract projects, and DEX volume is growing. AInvest

- However, there are concerns about a possible massive SOL dump: a large institutional or whale transfer has raised red flags on potential selling risk. Cryptonews

Outlook:

- Solana could carve out a bottom around $120–$125 if on-chain divergence plays out and developers keep building.

- A successful bounce could aim for the $133–$135 zone first; but for a stronger bull run, it needs to break beyond $175+, which is a major challenge given current macro volatility.

Market Sentiment & What Could Happen Today

- Macro Tailwinds: According to recent commentary, rate-cut odds have surged, which may be fuelling a rotation back into risk assets like BTC. 99Bitcoins

- ETF Flow Revival: Fresh ETF inflows into Bitcoin and Solana suggest institutional players might be stepping back in, potentially providing a bid at these support levels. Markets

- Divergence Opportunity: For Solana especially, rising on-chain activity (addresses, wallets) despite a low price could lead to a bullish divergence play if sentiment shifts.

- Risk Scenarios: If Bitcoin breaks below $80K, it could trigger a deeper correction. For ETH, a breakdown under $2,500 would be very bearish. For SOL, failure to defend $120–$125 could lead to more downside.

Bitcoin support resistance

BTC price Nov 22 2025

Ethereum correction risk

ETH support levels

Solana bullish divergence

SOL on-chain activity

Crypto ETF inflows

Altcoin analysis November 2025

Macro risk crypto market